Class Divides and Financial Literacy at Harvard

A Tax Return Horror Story and a Learning Opportunity All in One

By ALAYA AYALA

Last year, filing my tax return before April 15th turned into something of a nightmare for me. One of my outside scholarships had decided to send me a 1099-misc document, turning my scholarship money into taxable income. I owed the government money, and they happily took it, dramatically reducing the amount of a refund I could’ve used to help pay my family’s bills, purchase books the following semester, or even feed myself while I worked on campus the following May.

It was unfortunate, really, that I had to file my tax return on my own. I couldn’t afford to go home and work on it with my mom, so I had to call her every five minutes instead. I didn’t think to try to go to my nearest H&R Block or some other tax return filing service, mainly because I didn’t have the time to. My classes were beginning to buckle down in preparation for finals, and I barely had the time to spare by sitting down and wrestling with the free tax filing service I ended up using.

It was unfortunate, really, that I had to file my tax return on my own. I couldn’t afford to go home and work on it with my mom, so I had to call her every five minutes instead. I didn’t think to try to go to my nearest H&R Block or some other tax return filing service, mainly because I didn’t have the time to. My classes were beginning to buckle down in preparation for finals, and I barely had the time to spare by sitting down and wrestling with the free tax filing service I ended up using.

I mainly remember being terribly overwhelmed while filing, as it was the first time I’d really done it on my own, and having no one to talk to about it other than my mom. Everyone I knew at Harvard either didn’t have to file their tax returns, or had their parents do it for them.

I’d be lying if I said that that was a luxury that I wasn’t extremely jealous of at the time.

I’ve been at Harvard for more than a year and a half now, and sometimes the gap between the everyday lives of the more affluent students on campus and myself still astounds me.

Things that were necessary for me to do, like opening my own bank account when I turned eighteen, paying my own bills when I got to college, applying for my own credit card when I wanted to raise my credit score, signing myself up for direct deposit for my paychecks, and yes, even filing my own tax returns, are things that some of my peers have not even considered.

Thus, even today I still find myself asking questions and receiving looks of incredulity, as if the very concept of having to do some of the things I have to do is unfathomable.

“You mean you have never had to file your own tax return before?” was one such question, and it was met with raised brows and “of course nots.” And while I can’t blame my peers for never having to take their financial situations into their own hands, I do have to wonder what they’ll do when the responsibility eventually falls on them one day.

“You mean you have never had to file your own tax return before?” was one such question, and it was met with raised brows and “of course nots.” And while I can’t blame my peers for never having to take their financial situations into their own hands, I do have to wonder what they’ll do when the responsibility eventually falls on them one day.

When the government shut down last year extended late into January of this one, my immediate concern was for the state of my tax returns.The shutdown, coupled with changing federal tax laws from 2017, got me to wondering how my peers were feeling about something that could monumentally impact their ability to apply for financial aid in the coming years. Turns out, they weren’t as concerned as I thought they would be.

I remember feeling incredulous as I scrolled through my various social media feeds. Where was the student outcry? The worry? It made me wonder if my fellow Harvard Students even knew how much they could be impacted by their tax returns being in a potentially precarious position.

Naturally, I sent out a survey challenging my peers to tell me how much they knew about tax returns.

My first question was one that I saw as pretty necessary for people to know: Do you know what a W-2 is?

Of my 72 respondents, 63.9% knew what one was, while the rest had heard of it, but weren’t sure what the document was.

Here, I feel like I should mention that a W-2 is tax document that your employer sends out every year, detailing how much you made the previous year and how much you were taxed. It’s a pretty convenient document to have because it has your social security number on it, so if you ever find yourself at the RMV without a social security card, your W-2 will probably suffice as proof. (Speaking from experience here).

Here, I feel like I should mention that a W-2 is tax document that your employer sends out every year, detailing how much you made the previous year and how much you were taxed. It’s a pretty convenient document to have because it has your social security number on it, so if you ever find yourself at the RMV without a social security card, your W-2 will probably suffice as proof. (Speaking from experience here).

My second question was “What about a 1098-T?” Only 36.1% of my respondents knew what the document was, which isn’t that surprising because I didn’t know either until I had to file last year.

For those who are curious, the 1098-T is this cool document that your college sends out detailing how much you paid for tuition, how much of it was covered by scholarships, etc. This document is great if you’re planning to claim a tax exemption that’s directed at students.

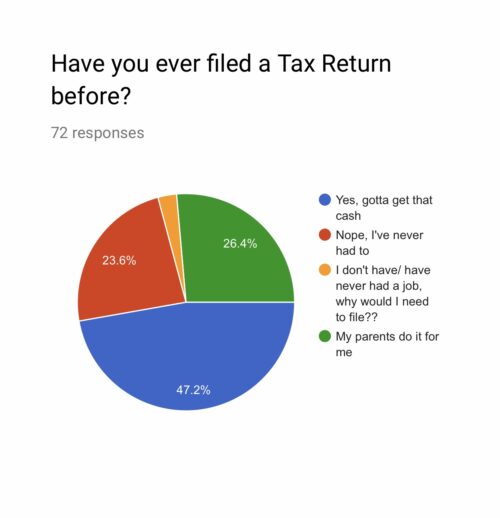

My survey revealed that only 47.2% of my respondents had ever filed a tax return before, a number that I doubt is really representative of how many Harvard students do file their returns on their own. Maybe one day a survey like this will reveal a more accurate number.

I was glad to see that a bit more than half of my respondents knew that there was a difference between a state and federal tax return.

The same applies to tax exemptions, which I think everyone should know more about.

I was concerned to see that only 11.1% of my respondents knew what the American Opportunity Tax Credit was, as even if you have never benefited from it before, it is something kind of important to know about if you are a college student.

I was concerned to see that only 11.1% of my respondents knew what the American Opportunity Tax Credit was, as even if you have never benefited from it before, it is something kind of important to know about if you are a college student.

I will say that the American Opportunity Tax Credit is a kind of tax exemption that you can claim if you’re a student who qualifies for it. It’s a bit more complicated than that in reality, but the truth is that if you don’t qualify for it, that’s kind of all you really need to know. If you are curious, there’s more information about it here.

My final questions had to do with important dates regarding tax returns that I thought my peers should know.

For those who are wondering, the correct answers are the following.

Your employer has to send out your W-2s by the end of January.

The IRS started accepting tax returns on January 28, 2019. (Which means you can file now if you have everything put together!)

Your tax returns are due by April 15th.

Thanks to everyone who took this survey, I feel like someone might learn something helpful about tax returns. I encourage everyone reading to take the time to find out more for themselves and spread the knowledge to others too.

Alaya Ayala (alaya_ayala@college.harvard.edu) isn’t looking forward to wrestling with her tax returns again this year.